- Articles

- Insights

Canadian Investment Attitude and Risk Survey from BetaPro by Global X

January 19, 2025First-ever BetaPro by Global X Investor Survey

Amid heightened economic and political uncertainty, more than one in four Canadians say they are willing to own riskier assets if it will help them achieve their financial goals. That sentiment comes at a time when investors report feeling less confident that they’ll be able to meet their financial goals than they were a year ago.

These were just some of the notable findings from BetaPro ETFs by Global X, managed by Global X Investments Canada Inc., in their first-ever survey of Canadian investors—designed to gauge investor sentiment and its potential impact on investment decisions. The survey, which was conducted by Angus Reid in December 2024, connected with more than 1,000 Canadian investors. This research comes at a time when investors are digesting major changes in the U.S. administration and uncertainties around the political landscape in Canada.

What’s shaping Canadians’ view of the economy?

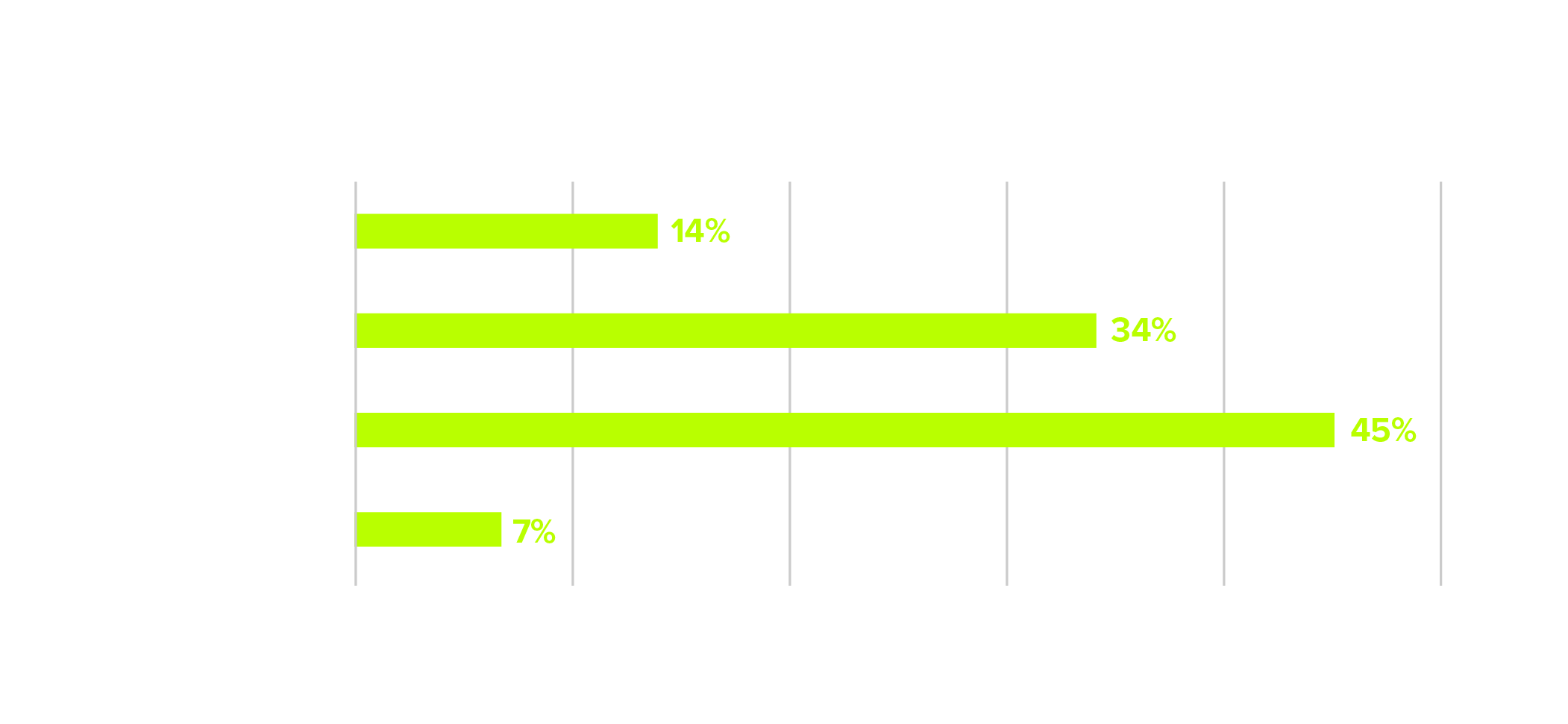

Despite finishing a year that saw the S&P/TSX Composite Index gain 18.5% and inflation returning to within the Bank of Canada’s target range, four out of five Canadian investors held an unfavourable view of the economy. Nearly half of respondents (45%) believe the Canadian economy is in decline, while another 24% say it is stagnant. Only 14% feel Canada is in a growth phase.

79%

of respondents describe the Canadian economy as either stagnant or in decline

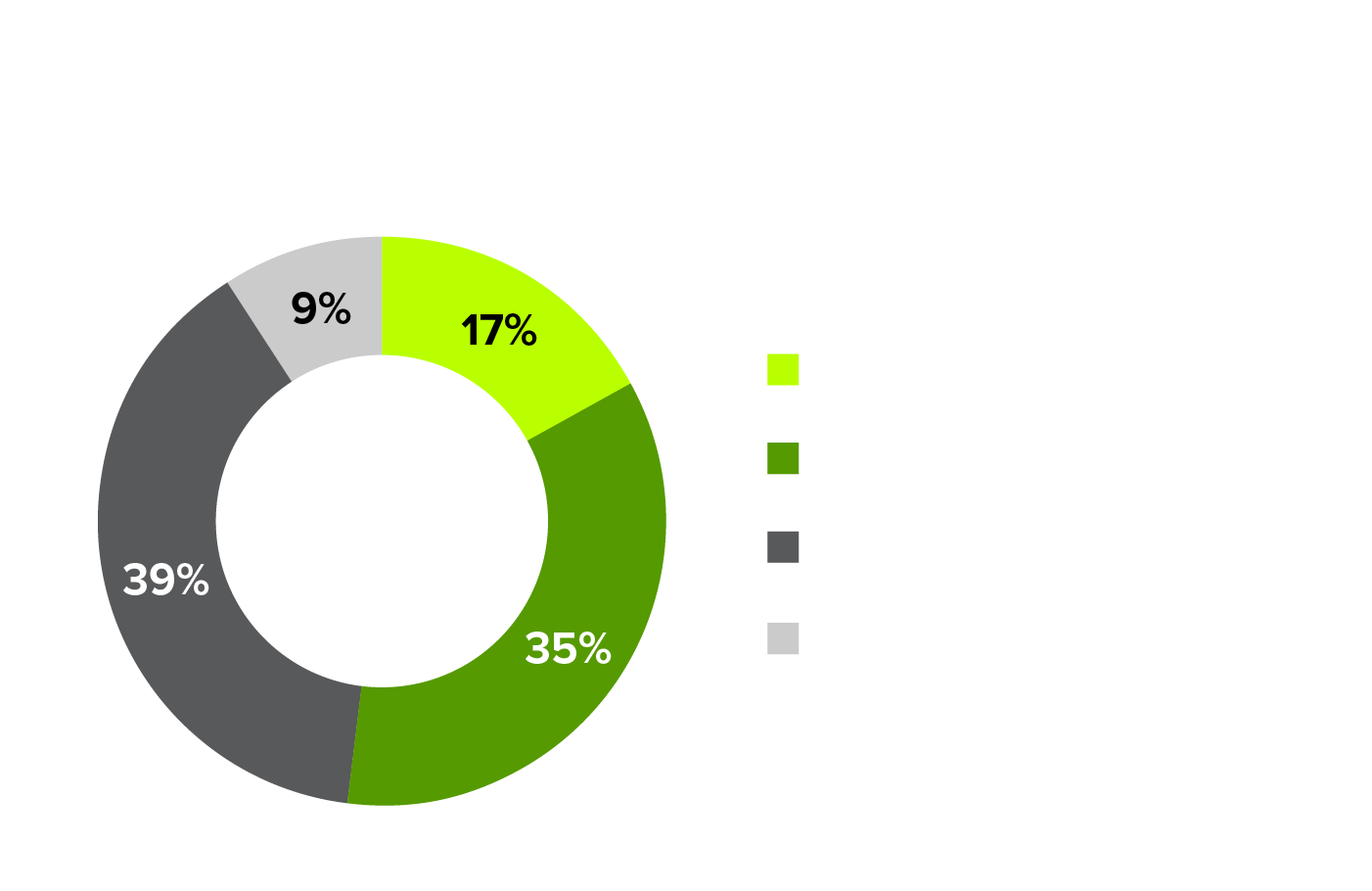

That somewhat dour view of the economy is contributing to a growing sense of worry shared by many of the respondents that they will not meet their financial goals. The survey found that 35% of respondents are less confident in their financial futures, while almost one in 10 say they don’t expect to reach their financial goals. Just 17% of respondents say they are more confident about their financial future than they were a year ago.

Lifting Canadian investor sentiment won’t be easy. As Canadians grapple with their views of the economy, they are also weighing how the shifting political landscape and a still-evolving economy will affect their portfolios. That includes the Bank of Canada’s interest rate decisions, a new U.S. administration and a new leadership in Ottawa, with a federal election slated to happen no later than October.

Still, respondents are divided on how these events will affect their investment opportunities. On the change underway at the White House, they are evenly split on how it will affect their investments, with 34% saying it will create more opportunities to increase returns, while 33% think it presents less opportunity.

Closer to home, respondents feel slightly more optimistic that the change in Ottawa will create more opportunities for their investments. About a third (35%) of them see the upcoming federal election as creating opportunities to generate returns, while 19% see it as creating less opportunity. Still, almost half of the country is either unsure or expecting no change to their investment opportunities regardless of who leads the nation.

There seems to be less certainty around whether the easing of rates by the Bank of Canada will help the respondents’ portfolios, with 33% seeing more opportunities for returns and 28% seeing fewer opportunities. The remaining 39% say they are either unsure or view those decisions as having no impact.

Political and economic worries driving investment strategy

Against this backdrop that could introduce volatility in the markets, many investors say they are not about to remain idle. The perception of the economy and the shifting political winds are having an impact on how some Canadian investors manage their investments. Even though only 3% of respondents described themselves as being big risk takers, a significant number say they will consider adding riskier assets to their portfolios if it would offer a potentially higher return to help them reclaim their sense of financial security.

The majority of respondents still believe individual stocks offer the strongest returns, but alternative investments, including cryptocurrency (19%), options (13%), hedge funds (12%), and leveraged ETFs (12%) are also capturing their interest. This suggests that some Canadian investors are looking beyond traditional investment vehicles as they seek higher returns amid market uncertainty.

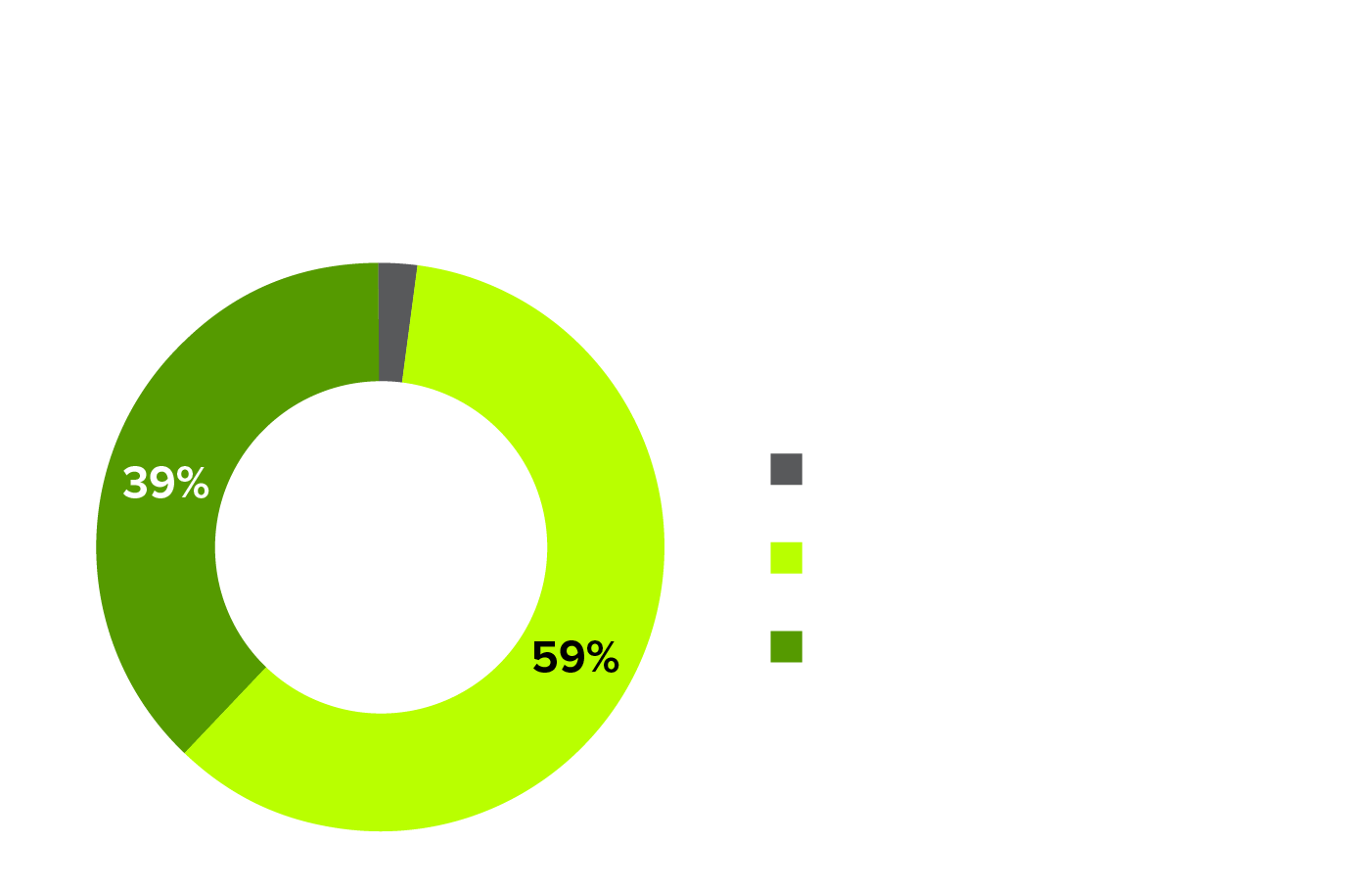

Overall, 27% of respondents say they would consider riskier investments, given the economy and their current financial position. That number jumps among younger investors. More than 40% of those between the ages of 18 and 35, express a willingness to explore riskier investments, compared to 35% for those between the ages of 36 and 55 and just 12% of those 56+.

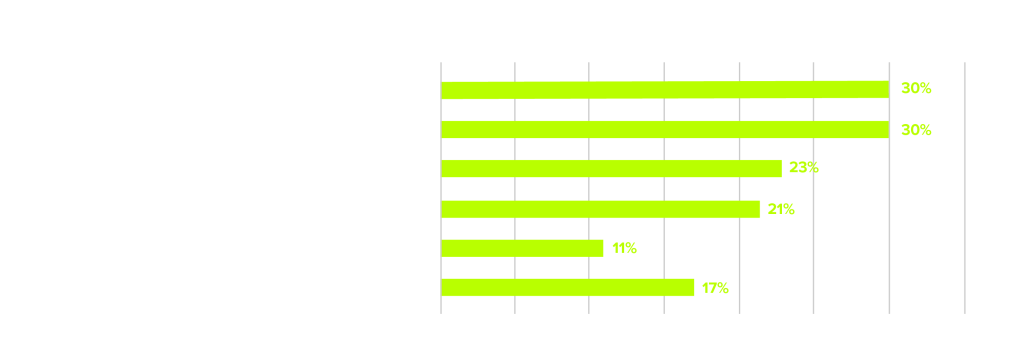

The reasons why people are willing to explore other asset classes should come as little surprise given their views on their current financial picture. While 30% of respondents feel comfortable taking on more risk if it could potentially boost their returns, many are entertaining the idea of risk to achieve their goals earlier (30%), boost the performance of an underperforming portfolio (23%), or to make up lost ground (21%).

41%

of respondents between the ages 18 and 55 would consider riskier assets if they offered a potentially higher return

Understanding alternative strategies

As respondents explore ways to boost their portfolios, many of them are not fully aware of all the alternative strategies available to them. Only 21% of respondents are aware of short-term, tactical trading opportunities like inverse or leveraged ETFs. Inverse, leveraged, and inverse leveraged ETFs, such as the ones from BetaPro ETFs by Global X, offer investors a way to get exposure to twice the performance (2x) or twice the inverse performance (-2x) of the underlying investments they attempt to replicate – but only for a single day.

Of the respondents who would consider using leveraged and inverse ETFs, 21% would use them to profit in a bear market, 14% to hedge against a loss, and 13% would short parts of a market (commodities, cryptocurrencies, technology stocks). Many of these same respondents said they would consider using inverse ETFs if they had more investable assets (50%). A significant number also said they’d use them to help reach their goals faster (27%), make up for disappointing returns from traditional investment vehicles (19%), or respond to an unstable economy (10%).

Charting an alternative path amid uncertainty

Despite the majority of respondents describing themselves as moderate risk takers, the survey shows they’re also pragmatic, finding that they’ll take on more risk in the short term if the situation justifies it. Many of them – particularly younger investors who feel more pessimistic about the economy and their investments – see alternative assets like inverse, leveraged, and inverse leveraged ETFs as a way to potentially earn higher returns to make up for lost ground and underperforming investments.

With the uncertainty around key events, like the U.S. election, Bank of Canada interest rate decisions, and the upcoming federal election, investors may have to be more agile as they navigate these potential challenges. While some see these events as opportunities for potentially greater returns, others view them as potential risks. This uncertainty reflects broader concerns about the economy, with investors unsure of the direction in which the market will move in the near future.

| About the respondents: The survey conducted in December 2024, reached 1,013 investors and reflects a range of ages, income levels, and genders. Of the respondents, 88% report having investable assets of at least $100,000. Roughly half (51%) of those surveyed use an advisor or other professional to manage their money, 32% consider themselves DIY investors who manage their own investments, with the rest using an online platform (10%) or relying on someone in their household to manage their investments (6%). |

DISCLAIMERS:

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity and conduct their research before investing. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies. By choosing to proceed, you accept and understand the disclosure provided above.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published January 21, 2025