Command the market

BetaPro by Global X is Canada’s leading provider of leveraged, inverse, and inverse-leveraged exchange-traded funds (ETFs).

For more than a decade, we’ve empowered active traders with the tools they need to navigate and harness rapidly changing markets. Our advanced lineup of ETFs offers daily exposure to various indices and commodities, from major indices, like the Nasdaq-100 and the TSX 60, to gold, oil, and Bitcoin.

Backed by Global X Investments Canada Inc., an innovative company managing more than $39 billion in assetsi, the diverse suite of BetaPro ETFs are designed to meet the demands of market-savvy investors seeking to take advantage of directional markets or hedge exposure for added downside protection.

BetaPro by Global X is a wholly owned subsidiary of the Mirae Asset Financial Group, a global powerhouse managing more than $800 billion in assets across 19 countries and global countries around the world.

iAs at December 31, 2024

Explore the betapro suite

FAQs

When it comes to investing, there is a lot to unpack — explore how ETFs can help.

Generally, BetaPro ETFs use financial instruments called “Forwards” – a derivative contract between two parties to buy or sell an asset at a specified price on a future date – to provide their leveraged, inverse and inverse leveraged exposure.

In order to achieve their investment objectives, the BetaPro ETFs may invest all or a portion of their portfolio in equity securities, interest-bearing accounts and T-Bills and/or other financial instruments, including derivatives such as futures contracts, options on futures contracts, swap agreements, options on securities and indices, or any combination of the foregoing.

None of the leveraged commodity ETFs invest in the physical spot commodity market.

Your risk for potential losses will not exceed your initial investment in the BetaPro ETF that you have purchased. This is in contrast to traditional leverage strategies, which tend to use lending mechanisms such as margin, which can lead to losses and debt obligations that exceed your initial investment.

These ETFs are designed to meet their investment objective only on a daily basis. Because these ETFs use leverage, potential gains and losses are magnified and, due to compounding, the performance over periods other than one day will likely differ in amount and possibly direction, from the reference index/commodity benchmark. Please read the prospectus and learn about all the risks associated with leveraged ETF investing.

Inverse and leveraged ETFs are tactical investment solutions that are primarily designed for the execution of a particular short-term investment strategy or perspective of the markets. These ETFs are designed to meet their investment objective only on a daily basis.

They are not appropriate as a buy-and-hold investment because these ETFs use leverage where gains and losses are magnified and, due to compounding, the performance over periods other than an individual trading day will likely differ in amount and possibly direction, from the reference index/commodity benchmark. Please speak to an advisor or read the ETF’s prospectus before investing in them.

Yes, as qualified investments, you can buy and sell all BetaPro ETFs within your registered accounts. This ability is particularly advantageous when it comes to inverse investing and certain leveraged strategies.

For instance, you can buy and sell BetaPro Inverse ETFs within your TFSA or RRSP where generally, short-selling individual securities to profit from a share price decline is typically prohibited by the CRA.

It’s important to keep in mind that individual tax considerations can vary. We recommend speaking to a tax professional to decide what makes sense for you.

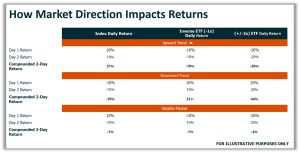

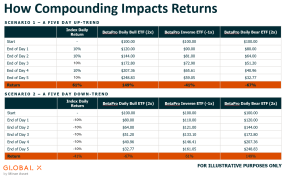

For BetaPro ETFs designed to deliver up to 2x or -2x the daily returns of a given benchmark index, investors will experience the effects of daily compounding, which amplifies both gains and losses over time.

For instance, if an investor holds a BetaPro 2x Daily Bull ETF and the underlying index rises 1% on Day 1, the ETF’s return will be 2%, effectively doubling the index’s performance. The $100 initial investment would grow to $102, providing leveraged exposure on Day 2. If the index rises another 1% on Day 2, the ETF would generate a 2% return on the now-higher base of $102, resulting in a total value of $104.04. This compounding effect can significantly amplify returns during consecutive periods of positive performance.

On the flip side, if the underlying index falls 1% on Day 1, the ETF would lose 2%, reducing the $100 investment to $98. On Day 2, the ETF’s exposure would adjust to $98. If the index falls another 1%, the ETF would lose 2% of $98, leaving the investment valued at $96.04. As the index experiences consecutive declines, the compounding effect reduces the investor’s capital base.

This daily compounding effect means that, over time, returns can diverge from the benchmark’s cumulative performance, especially in volatile markets.

Over extended periods beyond the fund’s stated holding timeframe—particularly during periods of significant market volatility—investment outcomes can vary considerably. In such cases, the benchmark index’s trajectory over time may be just as critical to the fund’s performance as the benchmark’s cumulative return for the same period.

For example, if $100 is invested in an index that drops 50% on the first day, its value falls to $50. On the second day, the index gains 100%, returning to $100. For a BetaPro Daily Bull ETF targeting up to 2X the index’s daily performance, the 50% drop results in a 100% loss on day one, reducing the ETF’s value to $0. It cannot recover, even though the index itself returns to its starting value.

For a BetaPro Daily Bear ETF targeting up to -2X the daily performance, the 50% drop results in a gain of $100, increasing the value to $200. However, on the second day, the 100% index gain resulted in a loss of $200 for the Bear ETF, reducing its value to $0 as well.

As a result, even though the benchmark index had a positive return, a BetaPro Daily Bull ETF that tracks it can have a negative return, due to the result of the events that take place during the said time.

Not necessarily.

The primary objective of a Daily 2X ETF is to achieve up to 200% (or up to -200%) of the index’s daily performance, before accounting for fees and expenses. This focus on daily performance means that returns over longer periods often diverge from the simple multiplication of the index’s performance by the ETF’s leverage factor.

Over time, the BetaPro ETF’s results may align closely with its daily target, but fluctuations in the market and the fund’s portfolio adjustments to meet its daily goals can cause deviations. These deviations might sometimes benefit investors but, at other times, may result in underperformance.

In markets with a consistent trend and low volatility, returns over periods longer than a single day may exceed the index’s return multiplied by the ETF’s leverage factor (e.g., up to 2X or up to -2X). However, in volatile markets, the ETF’s daily reset mechanism can magnify the impact of losses. For example, after a loss on one day, the ETF resets its exposure based on the lower portfolio value, which means subsequent gains are calculated from a smaller base. As a result, it takes a larger percentage gain to recover from a loss, and this compounding effect can lead to diminished performance over time, even when the index itself is relatively unchanged.

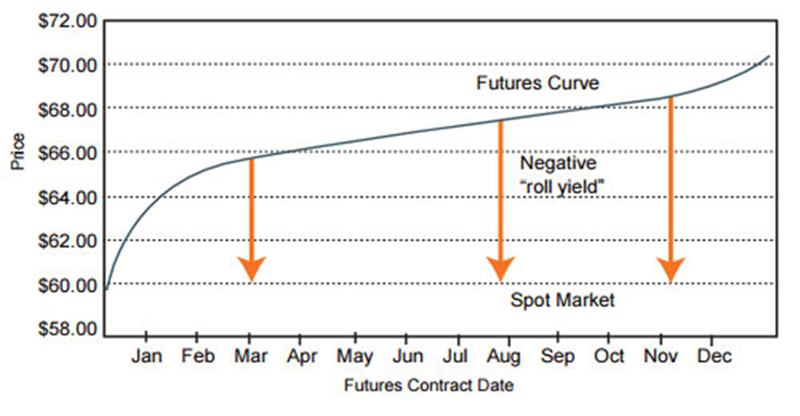

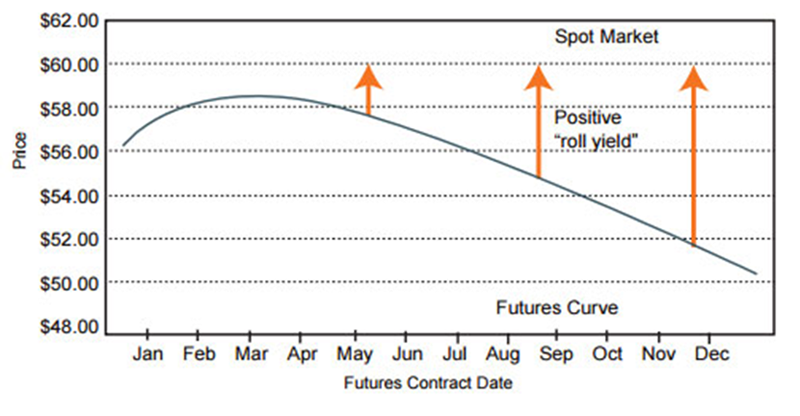

You might have heard about the impacts of Contango and Backwardation on commodity-focused investment funds that use “Futures” contracts.

BetaPro Commodity ETFs use financial instruments like Futures, called “Forwards”: derivative contracts between two parties to buy or sell an asset at a specified price on a specified future date that provide their leveraged, inverse and inverse leveraged exposure.

Instead of settling on the specified time in the future, the BetaPro Commodity ETFs typically roll from their specified delivery month to a subsequent delivery month before contract maturity (when the holder of the contract would be required to accept or make delivery of a physical commodity). This mechanism can lead to certain “Futures Curve” phenomena known as Contango and Backwardation:

Contango is a condition in which the price of a futures or forward contract is trading above the expected spot price at contract maturity, and the futures curve is upward-sloping. In a contango environment, a trader who is in long futures may experience negative “roll yield” if the contract is rolled after the futures price moves downward to converge with the expected spot price (assuming an unchanged spot price at maturity).

Even if the underlying commodity appreciates, as predicted by the futures curve at the time of the investment, the investor holding long futures may experience a loss. Typically, investors would want to be in short futures if the futures curve is in contango unless they expect the commodity to appreciate by more than what is priced into the futures curve.

Futures Curve in Contango

Backwardation is the inverse condition of contango, in which the price of a futures or forward contract is trading below the expected spot price at contract maturity, and the futures curve is downward sloping. In a backwardation environment, an investor who is in long futures may experience positive “roll yield” if the contract is rolled after the futures price rises to converge with the expected spot price (assuming an unchanged spot price at maturity). Even if the commodity declines, as predicted by the futures curve at the time of the investment, the investor holding long futures may experience no loss. Typically, investors would therefore want to be in long futures if the futures curve is in backwardation, unless they expect the commodity to decline by more than what is priced into the futures curve.

Futures Curve in Backwardation

Leverage on futures and forwards highlights that it is not enough to just get the directional call on the asset class right, traders also have to factor in the cost of future roll costs if the BetaPro ETF is being held over a multiple-day period.

None of these ETFs have ever paid a distribution since their respective launches.

However, it’s important to note that the Company may pay ordinary dividends, special Capital Gains Dividends or returns of capital on the BetaPro ETF Shares at the discretion of the Manager.

The BetaPro ETFs track a number of key benchmarks across different asset classes. Please see the specific page on the website to obtain the benchmark for any of the BetaPro ETFs.

BetaPro ETFs operate similarly to other ETFs in terms of liquidity. In addition to natural buyers and sellers in the secondary market, BetaPro ETFs each have dedicated market-making counterparties who continuously quote buy (bid) and sell (ask) prices for each ETF across eligible exchanges in Canada. They help facilitate transactions between buyers and sellers by standing ready to make trades, thereby helping improve liquidity and maintain reasonable bid-ask spreads. However, during periods of heightened market volatility, BetaPro ETFs may experience wider bid-ask spreads compared to non-leveraged ETFs.

Yes, BetaPro ETFs may from time to time go through a split or consolidation (occasionally referred to as a reverse split). When a share consolidation occurs, the net asset value per share is increased by the same ratio as the share consolidation so that the share consolidation has no impact on the value of the investor’s total share position. An investor’s cost per share is also increased by the same ratio as the share consolidation, although their total cost remains unchanged.

For CIRO Dealers and all discount brokerage platforms: No fractional shares will be issued. Where the consolidation results in a fractional share, the number of post-consolidation shares will be rounded down to the nearest whole share, in the case of a fractional interest that is less than 0.5, or rounded up to the nearest whole number, in the case of a fractional interest that is 0.5 or greater. Individual CIRO Dealers may support fractional share investing – please contact the appropriate CIRO Dealer support line for further information.

When a split occurs, the net asset value per share is decreased by the same ratio as the share split so that the share split has no impact on the value of the investor’s total share position. An investor’s cost per share is also decreased by the same ratio as the share split, although their total cost remains unchanged. Shareholders of HND on the record date will be entitled to receive additional shares for every share of HND they own on that date, as stated in the table above.

Spot Price is the price at which an asset is bought or sold for immediate delivery, while a futures contract price is the price at which an asset is agreed to be bought or sold at a specific date in the future.

Note: None of the leveraged BetaPro commodity ETFs invest in the spot commodity market.