- Articles

- Insights

Inverse and leveraged ETFs: Investing doesn’t have to be a waiting game

January 7, 2025Want in on a little secret? Some of the world’s most successful investors don’t rely exclusively on the long game, they seize on every market movement – big or small, up or down – to make money. They don’t wait for the market to come to them, they capitalize on daily movements by combining quick tactical trades, short selling and leveraging to amplify their gains.

It’s easy to see why savvy traders might want to make leveraged and other short-term moves part of their investment strategy. When you use leverage, which is essentially borrowing to invest, you can buy more of a security than you otherwise could. Small price movements can lead to larger gains relative to your initial investment, making it a powerful wealth-building strategy. Likewise, shorting, or inverse strategies, lets you profit – and even more so with leverage – from declines in a security, commodity or market.

Yet, despite the potential rewards that shorting and leverage can bring, these tactics aren’t often easy for individual investors to replicate. BetaPro by Global X fills that gap by making these strategies more accessible and easier to trade with leveraged and inverse exchange-traded funds (ETFs).

The low down on leverage and inverse ETFs

Leveraged and inverse ETFs are funds geared toward short-term, tactical trading opportunities. If you want a more sophisticated way to manage your wealth and can handle taking on greater risk for a potentially higher reward, then these products could be for you. (These are not your average buy-and-hold investments.)

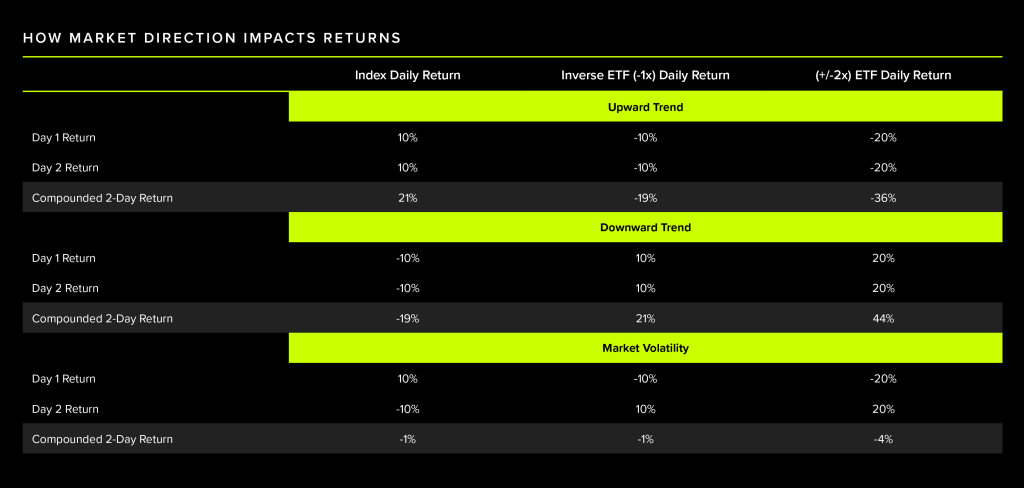

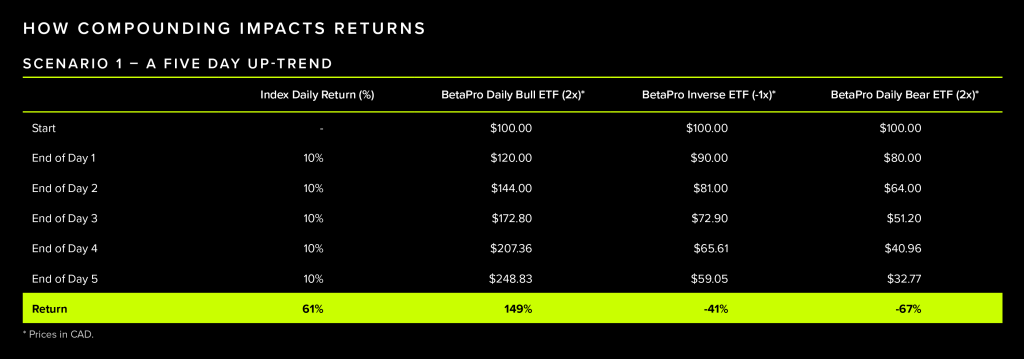

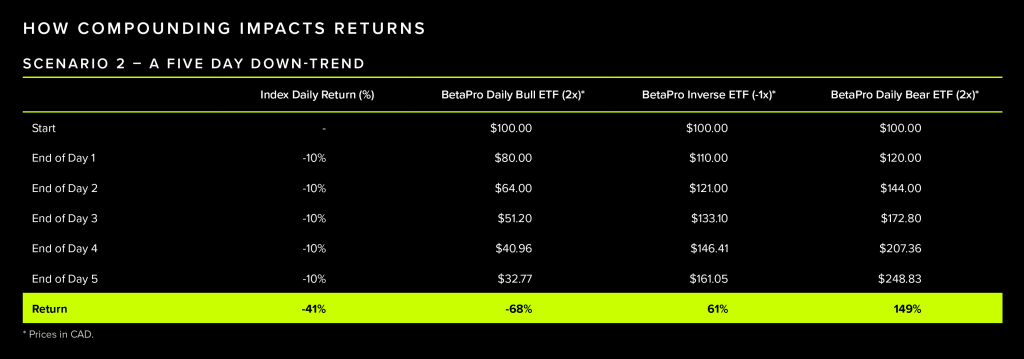

Unlike most ETFs, which aim to replicate the performance of the underlying commodities or securities they track, BetaPro’s leveraged ETFs (daily bull and bear) deliver up to twice the performance (up to 2x) or twice the inverse performance (up to -2x) of the underlying investments they attempt to replicate – but only for a single day. Any more than a day and the compounding effects of these leveraged products could cause the returns of your ETF to drift far from the underlying performance of the index or commodity the security tracks.

Here’s how it works: If the underlying index of a BetaPro 2x Daily Bull ETF rises 7% in a single trading day, the fund should deliver a 14% return. It’s a similar story for the BetaPro -2x Daily Bear ETF, but on the inverse, if the underlying index it tracks falls by 7% in one day, the investment should increase by 14%.

Now, if the underlying investment on the BetaPro 2x Daily Bull ETF fell by 10% on day two, it would have a cumulative return of -9%, whereas an unleveraged investment should have a cumulative return of -4%. That’s why these are tactical securities for short-term traders: you could make greater gains in one day, but if held for longer, there’s the potential that the returns can get out of sync with whatever the underlying commodity, benchmark or index the ETF tracks.

Want to go short on an investment theme, without added leverage? With single inverse ETFs, you can take a position that an underlying index will generate a negative return over a period of time and gain the potential to turn a profit from their decline!

Read more how inverse and leveraged inverse ETFs work here.

(BetaPro ETFs track all sorts of indexes and commodities, such as the S&P 500, oil, natural gas, the TSX 60 and more. See all of them here)

Hassle-free margin and shorting

One of the reasons why BetaPro’s innovative ETF lineup is the established leader in Canada and a go-to strategy for traders is that it doesn’t require you to use margin or shorting to get the benefits of leverage. Both are limiting on several fronts.

First, margin accounts are not permitted inside registered accounts, including Tax-Free Savings Accounts and Registered Retirement Savings Plans, meaning these strategies have been off limits to the accounts where they can potentially deliver the greatest impact.

The other issue is that margin trading requires you to maintain sufficient cash in your account as collateral to cover potential losses, which could limit your ability to benefit from this strategy. Just as a rising price can lead to an outsized gain, a falling price magnifies your losses and even puts you in a position where you could be required to find more money to meet your brokerage’s margin requirements.

You also need a margin account to short a stock, except with shorting, you borrow securities that are immediately sold with the intention of repurchasing them later at a lower price, pocketing the difference. Again, like trading on margin, there is no cap on your potential losses.

BetaPro ETFs address all of these issues.

Not only can BetaPro’s ETF lineup be held inside a registered account, these ETFs also greatly simplify trades. What’s key here, too, is that BetaPro’s approach helps cap your potential risk compared to the possible losses you could be exposed to if you were to try to execute leveraged or short trades on your own.

While leverage and shorting can lead to potentially unlimited losses, with BetaPro’s leveraged (up to 2x), inverse (-1x) and inverse leveraged (up to -2x) ETFs you can only lose as much as you put in and nothing more.

Take control of your trading strategy

Now that you’ve been let in on how some of the most active traders grow their wealth, it’s time to consider working this information into your own strategies. The accessibility of leverage and inverse strategies accessible will give you a lot more flexibility to manage your portfolio, maintain your momentum in down markets and transform small market movements into more meaningful gains.

Explore the power of leveraged, inverse and inverse leveraged ETFs to capitalize on market movements, help enhance returns and manage risk – all with the simplicity and accessibility of BetaPro by Global X.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity and conduct their research before investing. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies. By choosing to proceed, you accept and understand the disclosure provided above.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published January 20, 2025