- Articles

- Insights

Inverse ETFs: Here’s how you can get ahead when the market falls

January 7, 2025Over the course of four trading days in the summer of 2024i, the S&P 500 fell 6%, vaporizing gains that had been nearly three months in the making. It’s the sort of event that stresses investors, but to savvy traders, that kind of volatility offers another way to grow wealth.

Contrary to popular belief, it’s not necessarily the market direction that drives your returns, it’s your strategy. For years, institutional traders have been strategically shorting the market – they bet on stocks to fall – to bolster their returns and limit their downside. That strategy can be easy enough for large traders to implement, but not so much for individuals.

That’s because short-selling – also called inverse trading – can lead to unlimited losses for investors. Shorting requires investors to borrow a security from a broker, sell it at the current price and then repurchase it later at a lower price, pocketing the difference. The only way for individuals to short stocks is to open a margin account, which is used to pay for those borrowed shares and maintain a certain level of equity in the account to serve as collateral to ensure that the borrowed stocks get returned to the broker.

With a long-only position, you can only lose what you put in. But since a stock can continue climbing indefinitely, you can keep losing money – beyond your initial investment – as the share price climbs. The broker will eventually want their shares back, and the money you’ve borrowed to make any short sales. If you’ve lost a lot of money because of a short trade gone wrong, you could end up in debt to your broker.

Inverse and inverse leveraged ETFs, like those offered through BetaPro by Global X, provide a practical solution for Canadian traders. Inverse BetaPro ETFs are an easy-to-trade tool designed for investors to effectively go short on an index or asset and access leverage without anyone having to borrow stocks or open margin accounts. Unlike traditional short selling, you can apply this strategy in your non-registered accounts and registered accounts such as your RRSP, TFSA and FHSA.

Taming the bear

There are two main reasons why you may want to employ an inverse strategy. First, it allows you to take advantage of market downswings rather than just the ups like traditional, long-only investors. This approach can appeal to traders who take the view that a particular market, such as the S&P 500, oil or natural gas, is set to fall. Where most investors would lose money in a down market, if you make the right call with an inverse ETF, you should see a positive return.

Another way you might use this strategy is as a portfolio hedge to protect your longer-term investments from a potential market pullback. For instance, say the news starts flashing warning signs of a looming bear market for the S&P/TSX 60 or the S&P 500. You have a handful of choices – ride out the volatility, sell your investments or take action and hedge your exposure to protect your gains.

Trying to weather the storm in volatile markets can cut into your returns or even result in a loss that could take an uncertain amount of time to recover. Selling, on the other hand, might not be ideal either, as it could trigger capital gains or losses. By strategically hedging with Inverse BetaPro ETFs, you could potentially offset market declines with gains in your portfolio. However, this approach requires close monitoring of the ETF’s daily returns and, again, don’t hold it for the long term.

How it works

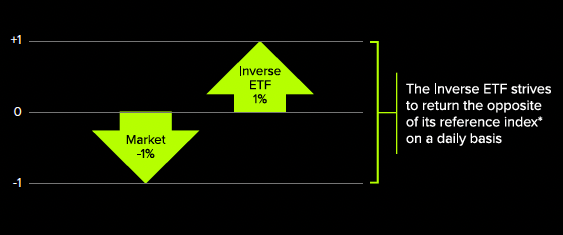

Here’s how Inverse BetaPro ETFs work: Say the market or underlying index declines by 1%, BetaPro’s Inverse ETF will strive to deliver a 1% gain before fees and expenses. If you already owned the underlying index through another ETF, this could effectively cancel out your loss.

FOR ILLUSTRATIVE PURPOSES ONLY.

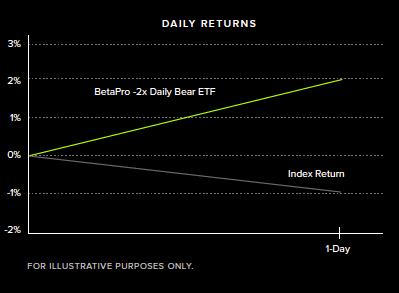

BetaPro also offers 2x Inverse ETFs, which have the potential to amplify your returns on smaller market movements. For instance, if the market declines by 1%, your trade could rise by 2% – resulting in a three-percentage-point swing. These ETFs use leverage, allowing you to potentially achieve greater potential returns on trades compared to traditional strategies.

However, inverse ETFs come with risks. These products are designed for short-term trades, not long-term holdings. In fact, BetaPro’s inverse solutions will only deliver the opposite performance of the underlying commodity or index for a single day. Because of how compounding and leverage work, if you hang on to the ETF for multiple days in a row, the returns will drift farther and farther away from the returns of the main index.

Say you own a 2x inverse ETF and the underlying asset increases by 7% on the day you purchased the fund. The ETF would fall by 14% on that day. If, on the next day, the underlying asset fell by 10%, then the same ETF would increase by 20%, giving you a cumulative positive return of 3% versus a -4% cumulative return for the index. As you can see from the chart, as the market rises and falls over time, the cumulative return of the ETF jumps around far more than the cumulative return of the index.

Other advantages

The BetaPro lineup of inverse and inverse leveraged ETFs offers investors the flexibility to apply this strategy across several market indices, including the S&P/TSX 60, the S&P 500 and commodities such as oil and natural gas. There‘s even a BetaPro Inverse Bitcoin ETF (BITI) for investors who believe the digital currency has risen too much, too fast.

While these strategies come with inherent risks, inverse ETFs can be a powerful tool to help hands-on investors generate alpha in their portfolios. Now, you can take control and seek to stay ahead of the market, while other traders fall behind.

Explore the potential of inverse ETFs to hedge against market declines and potentially amplify returns – all with the simplicity and accessibility of BetaPro by Global X.

iSource: Bloomberg, July 31 and August 5, 2024

Disclaimers

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (“Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (“Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”). The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to or equal to, either 200% or –200% of the performance of a specified underlying index, commodity futures index, or benchmark (the “Target”) for a single day. Each Inverse ETF seeks a return that is –100% of the performance of its Target. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF’s or Inverse ETF’s returns over periods other than one day will likely differ in amount and, particularly in the case of the Leveraged and Inverse Leveraged ETFs, possibly direction from the performance of their respective Target(s) for the same period. For certain Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to or -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF’s counterparties at that time. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

The VIX ETF, which is a 1x ETF, as described in the prospectus, is a speculative investment tool that is not a conventional investment. The VIX ETF’s Target is highly volatile. As a result, the VIX ETF is not intended as a stand-alone long-term investment. Historically, the VIX ETF’s Target has tended to revert to a historical mean. As a result, the performance of the VIX ETF’s Target is expected to be negative over the longer term and neither the VIX ETF nor its target is expected to have positive long-term performance. BetaPro Inverse Bitcoin ETF (“BITI”) which is an up to -1X ETF as described in the prospectus, is a speculative investment tool that is not a conventional investment. Its Target, an index which replicates exposure to rolling Bitcoin Futures and not the spot price of Bitcoin, is highly volatile. As a result, the ETF is intended as a stand-alone investment. There are inherent risks associated with products linked to crypto-assets, including Bitcoin Futures. While Bitcoin Futures are traded on a regulated exchange and cleared by regulated central counterparties, direct or indirect exposure to the high level of risk of Bitcoin Futures will not be suitable for all types of investors. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment. Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published January 20, 2025