- Education

- Insights

Gold or Silver: Taking a Leveraged Approach to Precious Metals

December 5, 2025Anyone who’s paid attention to the markets this year knows that precious metals have been on a tear. Gold is up 54% year-to-date[1] (as of November 18, 2025), while silver has soared by 74[2]%.

That’s significant for an asset class that’s typically viewed as a store of value or as an inflationary hedge, particularly when its outpacing the S&P 500’s 13.2% year-to-date return, as of November 18, 2025[3].

Naturally, those gains have sparked an even greater interest in gold and silver ETFs, with inflows into precious metal funds breaking all kinds of fund-flow records over the past year.

For sophisticated and active daily traders, leveraged and inverse-leveraged gold and silver ETFs offer an opportunity to potentially boost returns – whether on the way up or down, depending on where you might think metal markets are headed. Before buying, though, you need to know how these two metals work. Despite their seemingly coordinated rise, they do move differently from one another. Developing a thesis on why you’d want to own one or the other (or both) is also critical.

Let’s break it down.

Gold vs Silver

Gold and silver are forever linked, maybe thanks to the winner’s podium at the Olympics (and their centuries as currencies). However, these metals are not the same and tend to be driven by different market dynamics.

For one, gold doesn’t have as many use cases as silver. About 50% of gold demand is for jewellery, with India and China accounting for about half of that demand. Investment accounts for about 30%, while the tech sector, which uses gold in circuit boards and switch contacts, makes up about 6% of global demand.

It’s the investor segment that really impacts the price. Gold is seen as a store of value, meaning if the economy blows up, the metal will always be worth something. That’s why you often see demand for gold rise in uncertain economic environments (like we’re seeing today) – the more people think the world is going south, the more they buy gold to protect themselves against a worsening economy.

Silver, on the other hand, is a key ingredient in many industrial applications, including circuit boards, solar panels and electric vehicle batteries. According to the Silver Institute, in 2024, industrial accounts for 58% of demand, while investment only made up 18%. Silver is also considered a safe haven asset – like gold, it’s a finite asset and can hold its value, which is why the price tends to rise alongside the yellow metal. But when you factor in industrial demand, which rises and falls for all kinds of reasons, silver tends to be more volatile than gold.

Research has found that over the past six decades, gold has shown an average volatility of 16.2%, compared to 28.8% for silver. While many traders may want to take advantage of that volatility to potentially generate outsized returns on a given day, more ups and downs could negatively impact you, too. So, as a trader, you’ll want to weigh and consider how much risk you’re willing to take on.

Choosing between the two

When it comes to investing in gold and silver, many investors gain exposure through ETFs that mirror the spot prices for those metals. But if you want to take more of a view on where these commodities are headed and can tolerate some additional risk, then leveraged and inverse-leveraged funds can help you take advantage of these markets. BetaPro offers 2x and -2x for silver and gold, the BetaPro Gold Bullion 2x Daily Bull ETF (GLDU) and the BetaPro Silver 2x Daily Bull ETF (SLVU), as well as the BetaPro Gold Bullion -2x Daily Bear ETF (GLDD) and the BetaPro Silver -2x Daily Bear ETF (SLVD), respectively.

To build conviction in one or the other, you’ll want to pay attention to different indicators. Here’s what to look for in gold.

- U.S. Dollar Index: This measures the value of the U.S. dollar against a basket of other major currencies. Gold typically moves in the opposite direction of USD – when the dollar weakens, gold prices often rise because it becomes cheaper for foreign buyers to purchase.

- Inflation data: Key reports that could impact the direction of gold include the Consumer Price Index (CPI), which tracks price changes for goods and services; the Producer Price Index (PPI), which measures price changes at the wholesale level; and the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge. Higher readings across these indicators tend to boost gold demand as investors look for inflation protection.

- Central bank gold reserves: When central banks buy gold, it signals confidence in the metal as a store of value, which can help support prices.

- Retail investment flows: Rising inflows into gold ETFs often reflect stronger demand from individual investors seeking an accessible way to gain exposure to bullion. Sustained inflows can be a tailwind for prices, while steady outflows can have the opposite effect.

If you’re trading silver, the indicators look a little different:

- Manufacturing and industrial production: Silver demand rises when factories produce more electronics, solar panels, and other goods. Strong readings from data sources like the U.S. Federal Reserve’s Industrial Production report or global Purchasing Managers’ Index (PMI) surveys often point to higher silver demand.

- China’s economic growth: China is one of the world’s largest consumers of silver for industrial uses. Monthly figures such as industrial output and export growth can give traders a sense of how silver demand might trend.

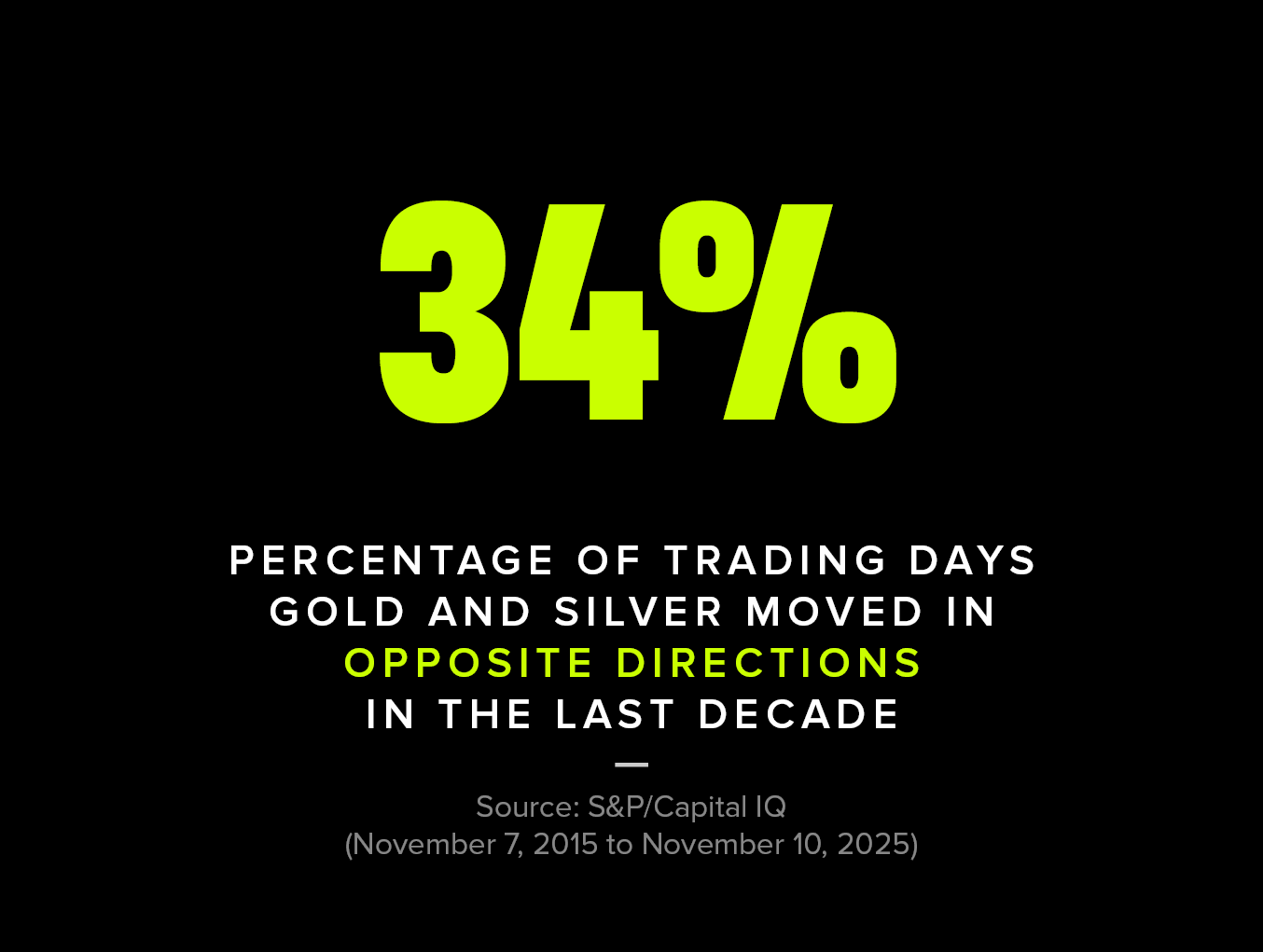

Finally, some traders may prefer to trade both metals together in what’s known as a ‘Pairs trade’, taking opposite positions in gold and silver to profit from an expected divergence in relative performance. While gold and silver tend to move in unison over the long term, they react differently to market conditions in the short term.

BetaPro’s Bull and Bear ETFs offer an easy way to execute this trade – and possibly, supersize the potential benefits. For instance, if you expect global growth to slow and boost gold prices, then you could buy a 2x gold ETF and a -2x silver ETF to capture some additional positive return should industrial demand for silver start to weaken. Conversely, if manufacturing picks up and clean energy spending increases, a trader could flip the trade by buying an inverse-leveraged gold ETF and a leveraged silver ETF.

An investment in any of the BetaPro products is appropriate only for investors who have the capacity to absorb a loss or some or all of their investments. Investors should monitor their holdings in BetaPro products and their performance at least as frequently as daily to ensure their investments remain consistent with their investment strategies.

Whether you trade gold, silver, or both, leveraged bull and bear ETFs can help you act on market trends in either direction. Just remember: these products are designed for daily exposure, and the more volatile the market, the faster results can compound in unpredictable ways.

[1] Google Finance, https://www.google.com/finance/quote/GCW00:COMEX?window=YTD

[2] https://www.google.com/finance/quote/SIW00:COMEX?window=YTD

[3] https://www.google.com/finance/quote/.INX:INDEXSP?window=YTD

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity, and conduct their research before investing. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published December 5, 2025