- Education

- Insights

What You Need to Know About the Daily Reset

December 5, 2025For investors turning toward leveraged and inverse-leveraged ETFs in the pursuit of raising their risk-reward tolerance and returns in their trading accounts, it’s important they fully understand how these products work –especially when it comes to what’s called “the daily reset.”

Traditionally, leverage involves borrowing from your financial institution and using those funds to invest in the market alongside your own capital. If you have $1,000 to invest and borrow $1,000, you now have $2,000 – effectively 2x leverage. In this case, your money rises and falls with the market, and you might still owe $1,000 to the financial institution if the investment goes to $0.

With leveraged and inverse-leveraged ETFs, you’re not borrowing from a broker – you’re putting your $1,000 into a fund. The fund company, working with a bank, is responsible for securing the leverage. That leverage remains consistent – in the case of a 2x fund, that’s 200% of the fund’s net assets. Here’s where the daily reset comes in.

Every day, the assets in the underlying index shift, which causes the value of the assets within the ETF to shift as well. To maintain the required leverage, the fund’s exposure to its target market must be adjusted daily, increasing leverage when the fund’s value rises or reducing it when the value declines. This reset process is critical to ensure the fund achieves its stated objective of providing a fixed-level market exposure for a single trading day.

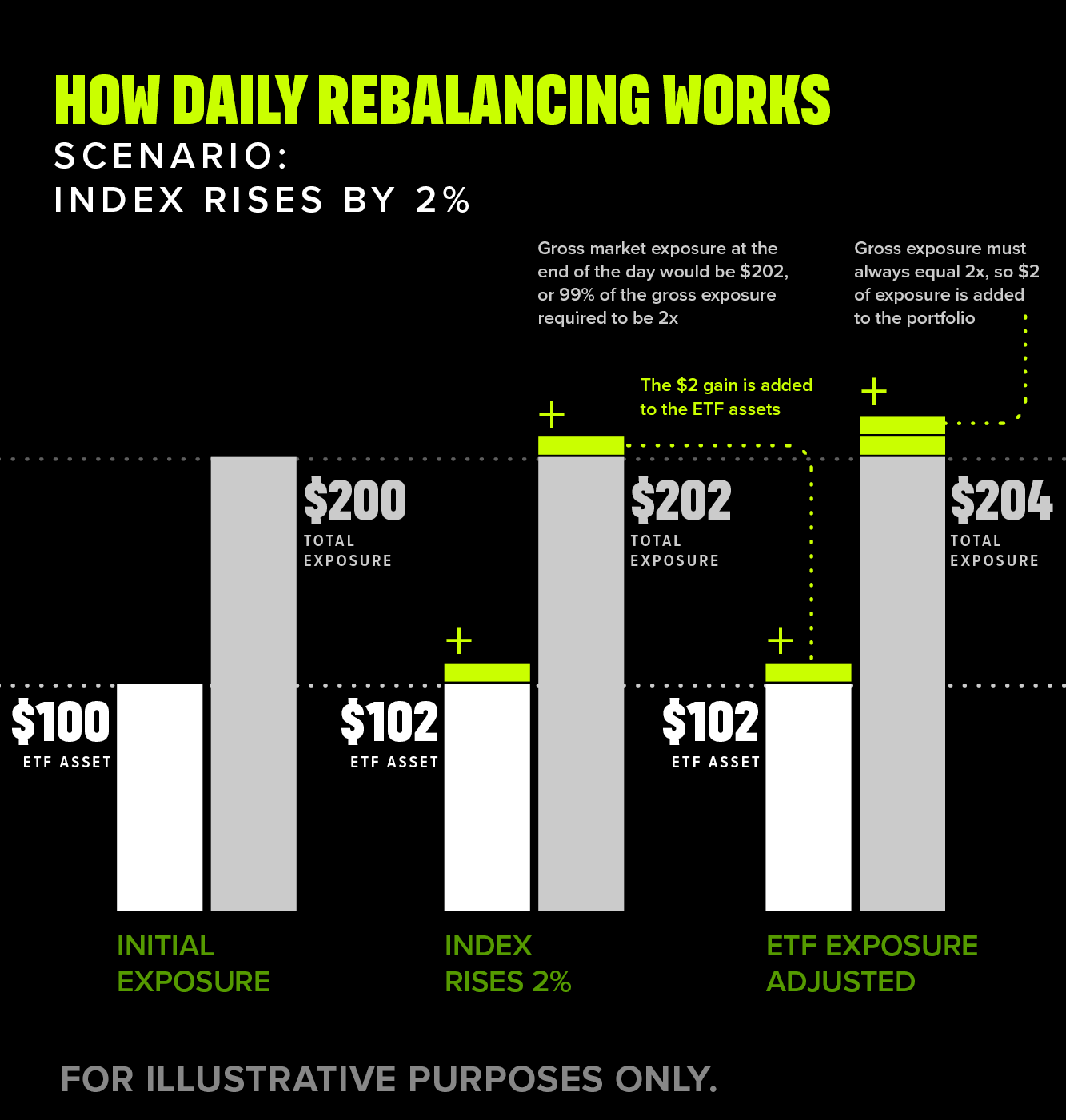

Here’s how it works for the BetaPro S&P 500® 2x Daily Bull ETF (SPXU):

- Start of day: ETF has $100 in assets and sets $200 of index exposure.

- During the day: The S&P 500 rises 2%. The exposure gains about $2.

- End of day: Assets are now about $102 and exposure is $202.

- The reset: To ensure the fund meet its target leverage amount, the fund tops up its exposure to $204 (which is 200% of $102) so it starts tomorrow at 2x again.

Now, if the S&P 500® falls by 2%, here’s how SPXU should hypothetically react:

- Start of day: Assets $100, exposure $200.

- During the day: The S&P 500 falls 2%. The exposure loses about $2.

- End of day: Assets are now ~$98 and exposure is ~$198.

- The reset: The fund trims exposure to $196 (200% of $98) so it starts tomorrow at 2x again.

Why this matters to you

Leveraged and inverse ETFs are designed for sophisticated investors seeking daily, tactical trades and who are comfortable managing investments with higher risk potential. These ETFs are not for long-term buy-and-hold strategies. Because they reset daily, their performance over weeks or months can deviate sharply from the underlying index’s cumulative return — even if the index ends up where it started. That’s due to the effects of compounding and volatility decay: in volatile markets, gains and losses on successive days don’t cancel out and that can erode returns.

For example, if an index rises and falls repeatedly around the same level, a 2x ETF may lose money despite the index breaking even. It’s important to understand how the daily reset works so you use these funds strategically — for hedging, short-term directional bets, or intraday trading — but you should monitor them frequently and daily to ensure your investment remains consistent with your strategies.

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity, and conduct their research before investing. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published December 5, 2025