- Education

- Insights

Why the S&P 500 Can Make for a Solid Short-Term Trade for Investors

October 27, 2025If there’s one broad-based index investors think of when they talk about markets, it’s the S&P 500. Since 1957, the index has been seen as a proxy for the overall U.S. market, comprising the 500 largest companies trading on U.S. stock exchanges.

Unlike the tech-heavy and often volatile Nasdaq, many investors view the more diversified S&P 500 as a buy-and-hold investment. The fact that the three largest U.S.-based ETFs are all focused on the S&P 500, holding more than US$2 trillion in assets(1), is no coincidence.

You might be surprised to learn that the S&P 500 is also a favourite among short-term investors and traders. Why? Because even though the index has trended higher over time, many see the daily ebbs and flows as an opportunity to use leveraged and inverse-leveraged ETFs to increase their potential for gains

A case for the S&P 500

There are a number of good reasons why short-term investors like tapping into the S&P 500. Here are a few of the key ones:

Increase diversification

The S&P 500 index is one of the more diversified indexes, which means you’re taking on as much risk as you would with other investments. Saying that, it still has around 34% exposure to technology and includes Nvidia, Microsoft and Apple in its top three holdings. That allows you to take a more measured approach to capitalizing on big tech-driven market moves, without being subject to some of the more extreme ups and downs that can potentially come with trading a more concentrated index, such as the Nasdaq, which has a 60% allocation to tech.

Taking a tactical approach

Since the S&P 500 serves as the primary benchmark for the overall health of the U.S. market, it’s easier to make tactical moves using this index than others. If you think a poor jobs report is on the horizon based on your own economic analysis or that a change in interest rate policy is in the cards, then the S&P 500 could be a good index to use to express your views.

Easier to understand volatility

Short-term investors like to trade on volatility, trying to make money off big swings or declines, but it’s impossible to predict how the market will move. While you can’t know the S&P 500’s future, there are data points out there that can help you make an educated guess. The CBOE Volatility Index (VIX) is a good example. This index measures investor expectation of volatility on the S&P 500 over the next 30 days.

About 80% of the time(2), the VIX moves in the opposite direction of the S&P 500. That’s because the VIX is a measure of fear and uncertainty – a rise could mean investors are nervous and likely to sell. The VIX shouldn’t be seen as a predictive tool because you never know when the two will move in lockstep, as it does 20% of the time, but it can be one of many inputs that can help inform your decisions.

Mitigating single stock risk

Many investors trade single stocks, which can be a high-risk endeavour. There is no shortage of cases where a stock drops a massive amount in one day. Trading the ups and downs doesn’t mean you need to put yourself at the whim of a CEO scandal, a missed earnings report or a bad rebranding effort. The S&P 500 can see big moves, but that’s often a 1% or 2% rise or fall. Since 2008, the index has dropped by more than 7.5% in a single day seven times(3), with all those declines coming in either the 2008 Great Financial Crisis or the COVID lockdowns in 2020.

Applying leverage

Because the S&P 500 tends to experience fewer large swings, it is often viewed as a relatively stable benchmark for strategies involving leveraged or inverse-leveraged ETFs. These ETFs—available in 2x, 3x, -2x, and -3x variations—are designed to provide magnified exposure to the index’s daily performance, allowing investors to observe market movements in a different way than traditional passive S&P 500 ETFs.

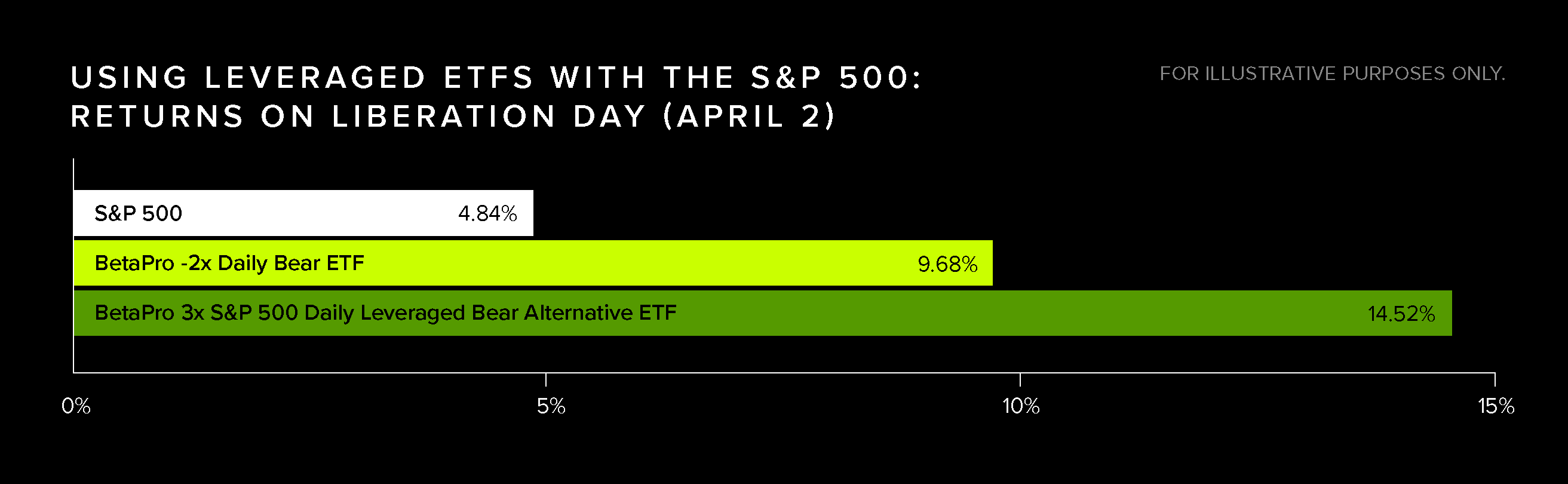

For instance, if you held an inverse ETF on April 2 – the day the U.S. first introduced its reciprocal tariffs on most of its major trading partners – you would have made about 4.84%, which is how much the market fell on that day. If you were holding the BetaPro S&P 500 -2x Daily Bear ETF, you might have made 9.68% on the drop. While the BetaPro 3x S&P 500 Daily Leveraged Bear Alternative ETF only became available to investors on June 17, if you could own it back then you would have made 14.52%.

Unlike a traditional S&P 500 ETF, though, leveraged and inverse-leveraged funds aren’t meant to be held for more than a day or two. That’s because, without a clear market direction, they can suffer losses over multiple days from compounding and the daily resetting of market exposure.

For those paying attention to their investments and have a clear point of view to express through their investments, then it can pay to play the S&P 500.

Sources

1 https://www.tradingview.com/markets/etfs/funds-largest/

2 https://www.cboe.com/insights/posts/inside-volatility-trading-breaking-down-the-vix-index-and-its-correlation-to-the-s-p-500-index/

3 https://www.hartfordfunds.com/practice-management/client-conversations/managing-volatility/top-10-stock-market-drops-recoveries.html

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity, and conduct their research before investing. An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published October 27, 2025