- Articles

- Insights

The Wednesday Report Oil Traders Can’t Ignore

September 8, 2025As the saying goes, you can’t time the market, but when it comes to oil and natural gas, seasoned traders know precisely when to watch it. Every Wednesday at 10:30 a.m. (ET) something predictable happens: the U.S. Energy Information Administration (EIA) releases an inventory report and, like clockwork, the markets respond – often with sharp price moves up or down.

The EIA release has become a recurring catalyst for investors. A report showing a surprise increase in oil, natural gas, gasoline or distillates (e.g. diesel and heating oil) stockpiles often sends stocks lower, while equities tend to snap higher within seconds of an unexpected drawdown in inventories and stronger demand.

The trend has been well documented. A paper published in 2021 found that market reaction following the release of the EIA report “can significantly and positively predict the returns in the last half-hour.” No other trading days exhibited this type of predictive behaviour. The paper’s conclusion: “Substantial economic gains can be made by using efficient intraday predictors as trading signals.”

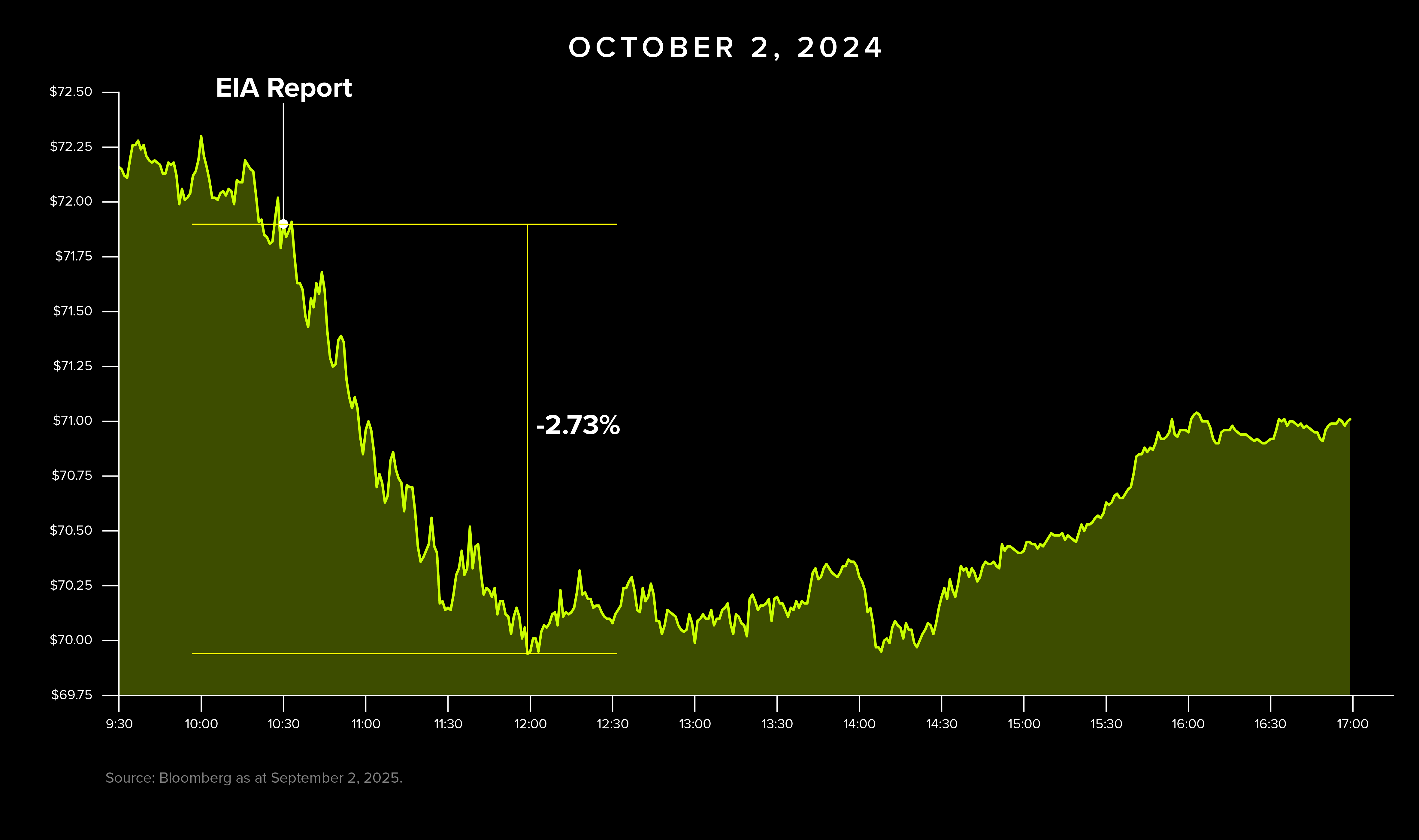

Most weeks, you can pinpoint when the EIA report was published just by looking at an intraday graph.

- August 13, 2025: Crude prices fell 1.4% within 90 minutes of an EIA report.

- July 9, 2025: Oil prices were up 0.7% within 30 minutes of the EIA release, en route to a 1.2% gain by early afternoon.

- October 2, 2024: Prices trended higher early in the session but sharply reversed after the EIA report showed rising inventories and weakening demand. By noon crude prices were down by nearly 3%.

While the initial move following the release can be fairly pronounced, the early moves often set the tone for the rest of the trading day. It’s important to have a strong idea of where you think markets might head depending on the news. Build conviction by looking at historical data on how markets have reacted to past reports and ensure you’re on top of any other news or data that could influence the market’s direction.

That context is important as other factors could influence investor reaction to that data. For example, the July 9th report showed that crude stockpiles rose unexpectedly, yet oil rallied. Normally, rising inventories would be a bearish signal, but investors saw it as a temporary situation, as the report also showed declines in gas and distillates.

How to trade on the EIA report

A one-percent intraday swing in crude oil may appear minor, but in the context of leveraged products such as the BetaPro Crude Oil Leveraged Daily Bull ETF (HOU) or the BetaPro Crude Oil Inverse Leveraged Daily Bear ETF (HOD), these moves can translate into amplified performance. With two-times leveraged exposure, even modest price changes may result in greater variability, which some traders monitor as potential opportunities.

The same EIA report also provides updates on natural gas stockpiles, which can influence market activity. Products such as the BetaPro Natural Gas Leveraged Daily Bull ETF (HNU) and the BetaPro Natural Gas Inverse Leveraged Daily Bear ETF (HND) are designed to deliver two-times daily leveraged exposure to natural gas prices.

Given the volatility often seen in crude and natural gas following the EIA release, these ETFs may experience significant short-term performance swings. It’s important to note that they reset daily and can underperform in choppy markets.

With two-times leveraged exposure, even modest price swings can create meaningful trading opportunities. Just remember: market reactions to the weekly EIA report can be unpredictable. While there is no way to know how the market will react to the report from week to week, the predictable timing of the release gives investors a consistent window to invest around.

For active traders, the EIA report offers a rare moment of predictability in an otherwise volatile market.

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (“Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (“Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”). The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to or equal to either 200% or –200% of the performance of a specified underlying index, commodity futures index, or benchmark (the “Target”) for a single day. Each Inverse ETF seeks a return that is –100% of the performance of its Target. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF’s or Inverse ETF’s returns over periods other than one day will likely differ in amount and, particularly in the case of the Leveraged and Inverse Leveraged ETFs, possibly direction from the performance of their respective Target(s) for the same period. For certain Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF’s counterparties at that time. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

The BetaPro Products include the 3x and -3x ETFs and will use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These 3x and -3x ETFs are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their prospectus. Each 3x and -3x ETF seeks a return, before fees and expenses, that is equal to either 300% or –300% of the performance of a specified underlying index (the “Target”) for a single day. Due to the compounding of daily returns, a 3x and -3x ETF’s returns over periods other than one day will likely differ in amount and possibly direction from the performance of their respective Target(s) for the same period. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for sophisticated investors who have the capacity to absorb a loss of some or all of their investment. Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published September 8, 2025