- Education

- Insights

Managing currency risk on your leveraged and inverse-leveraged ETFs

August 12, 2025When it comes to investing, reducing the number of uncontrollable variables can make all the difference. For Canadians trading U.S.-listed or unhedged Canadian-listed ETFs, that can mean dealing with currency fluctuations, which can distort returns by either eroding or boosting returns without any warning.

Currency is hard to manage on any investment, but with a high-performance investment like a 3x leveraged or 3x inverse-leveraged ETF, trying to manage foreign exchange (FX) on your own is like flying a jet into the wind: you’ll eventually reach your destination, but you’ll burn more fuel and potentially lose momentum. While the impact FX can have on these investments hasn’t discouraged Canadians from owning them – Investor Economics reporting that Canadians hold more than $4 billion in U.S.-listed leveraged, inverse and inverse-leveraged ETFs – it’s a risk many investors would likely rather avoid.

Fortunately, there is a way to help take currency risks out of the mix: Own Canadian-listed and Canadian-hedged versions of the 3x and -3x leveraged ETFs. BetaPro by Global X is the only Canadian ETF provider that offers CAD-hedged leveraged and inverse leveraged funds, including the recently launched BetaPro 3x S&P 500 Daily Leveraged Bull Alternative ETF (TSPX) or the BetaPro 3x Nasdaq-100 Daily Leveraged Bull Alternative ETF (TQQQ). There are inverse-leveraged versions of these, too. BetaPro ETFs are built for sophisticated traders who like making short-term, tactical moves and are comfortable taking on higher risk. They’re designed for daily use, need active monitoring, and aren’t the right fit for everyone.

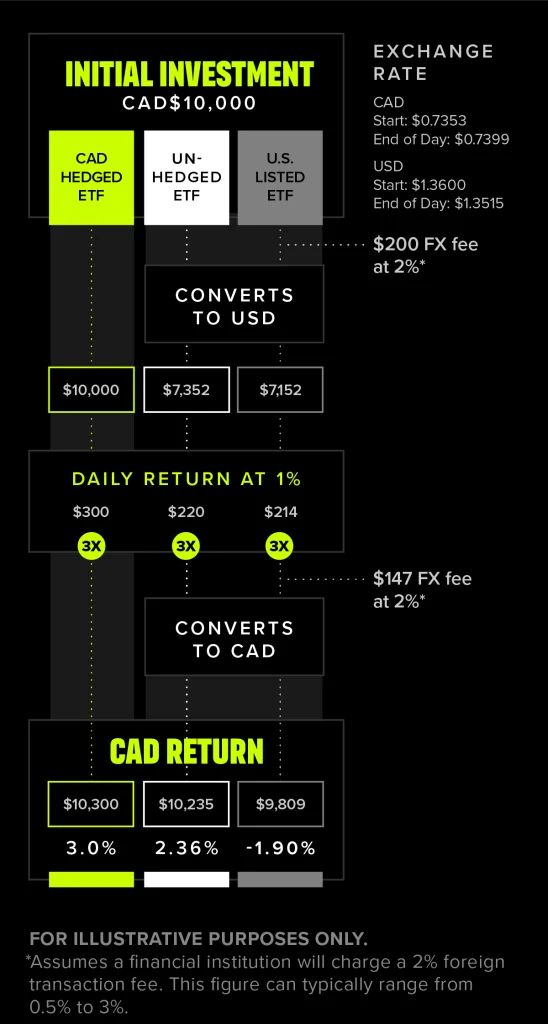

Consider an investor who buys a U.S.-listed 3x Bull ETF hoping to profit from an expected upswing in the S&P 500 index. Investing CAD10,000 when the U.S. dollar is trading at CAD1.36 theoretically costs USD7,352 (not including FX fees, another big cost for traders). Say the S&P 500 increases by 1%. With a 3x leveraged ETF, you would expect to get 3% or CAD300, three times the profit you’d earn with a standard S&P 500 ETF, but that’s before currency conversion costs, taxes and trading fees.

This is where the math is important.

If you want to own an investment that trades in U.S. dollars, currency fluctuations will impact the value of your investment from the outset. That’s because you have to convert your loonies into greenbacks before you can start trading (or your ETF provider does, unless the investment is CAD-hedged).

For instance, in May 2025, the biggest one-day increase in the U.S. dollar was 0.62% and the largest decline was -0.84%. Depending on the day you were trading, Canadian-dollar returns may have differed wildly from the 3x return you were targeting. If you were lucky, currency fluctuations boosted your profits. Otherwise, your gains could be erased by a rising loonie – a trend that is currently playing out in 2025.

If you’re trading in a Canadian-dollar account, your broker might also charge a spread for the currency conversion, which could reduce or eliminate your investment. This fee can range from 0.5% to 3%, depending on the financial institution. This is a big issue for 3x and -3x funds specifically. Given that these funds are for daily trading, if you must continually convert currency from USD to CAD, you could end up paying hefty currency conversion fees that could further erode your return, let alone the currency fluctuations themselves. Remember, you’ll get hit with this fee twice since you have to convert your money back to CAD once you sell your investment.

If you’re trading a Canadian-listed unhedged ETF, you won’t need to worry about the upfront costs of FX conversion before you trade, but your returns will still be influenced by currency fluctuations.

Here’s a look at how a CAD10,000 investment in the BetaPro 3x S&P 500 Daily Leveraged Bull Alternative ETF and its U.S. counterpart would perform if the Canadian dollar rose after your initial investment:

With BetaPro ETF’s recent launch of currency-hedged 3x leveraged and -3x inverse and inverse leveraged ETFs, Canadians can now trade these funds in Canadian dollars, helping reduce the impact of currency fluctuations.

By trading in Canadian dollars, you can focus on managing these positions and executing your trading strategies more confidently, without the added concern of unexpected currency swings.

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (“Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (“Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”). The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to or equal to either 200% or –200% of the performance of a specified underlying index, commodity futures index, or benchmark (the “Target”) for a single day. Each Inverse ETF seeks a return that is –100% of the performance of its Target. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF’s or Inverse ETF’s returns over periods other than one day will likely differ in amount and, particularly in the case of the Leveraged and Inverse Leveraged ETFs, possibly direction from the performance of their respective Target(s) for the same period. For certain Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF’s counterparties at that time. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

The BetaPro Products include the 3x and -3x ETFs and will use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These 3x and -3x ETFs are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their prospectus. Each 3x and -3x ETF seeks a return, before fees and expenses, that is equal to either 300% or –300% of the performance of a specified underlying index (the “Target”) for a single day. Due to the compounding of daily returns, a 3x and -3x ETF’s returns over periods other than one day will likely differ in amount and possibly direction from the performance of their respective Target(s) for the same period. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for sophisticated investors who have the capacity to absorb a loss of some or all of their investment. Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published August 12, 2025