- Articles

- Insights

Here’s why the U.S. Nasdaq-100 is a go-to index for Canadian Traders

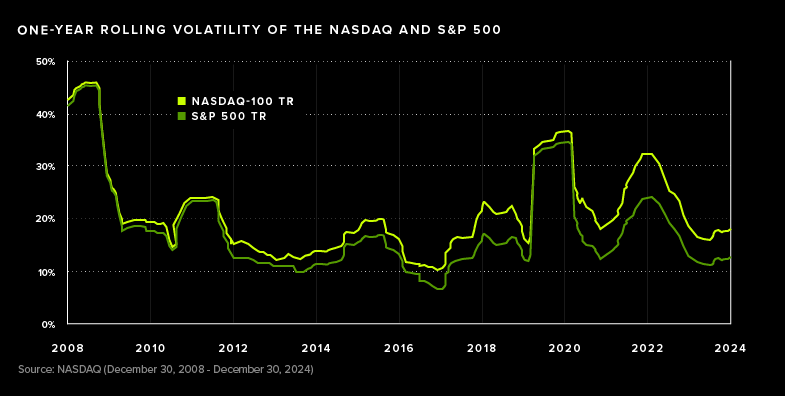

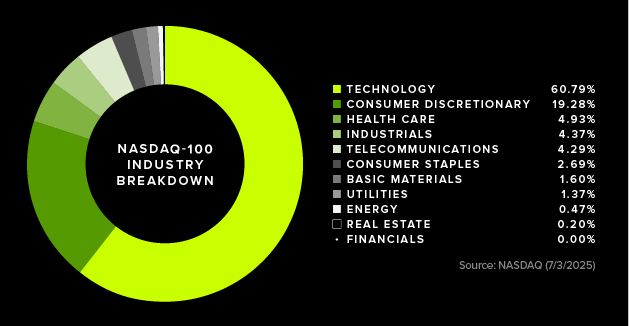

July 11, 2025Among the world’s major stock indices, the Nasdaq-100 has long been a favourite of traders and investors interested in taking advantage of the market’s ups and downs. It has a higher annual volatility than most other indexes, in large part due to its makeup of major technology stocks, which can both fly high and experience sharp bouts of volatility.

Over the past decade, the Nasdaq, which counts Nvidia, Microsoft, Apple, Amazon and Meta in its top five holdings, has boasted an annualized return of 16.7% through the end of 2024. By comparison, the S&P 500 has a 12.2% annual return over the same period. Of course, no index typically climbs in a straight line. The Nasdaq, in particular, has experienced significant bouts of volatility over the years.

According to Nasdaq, the index provider and data as of June 30, 2025, its one-year annualized volatility (total return), which measures how much an asset’s price fluctuates over the year, was 25.73%, its three-year was 25.62%, while several other years going back a decade exceeded 20%. By comparison, according to S&P, its index’s annualized return over the same periods are 19.88% and 19.38% respectively.

That level of volatility can be unnerving for some, but it’s the type of environment where short-term investors can thrive. The Nasdaq-100’s frequent price movements offer traders a potential opportunity for daily gains, as long as they can manage their risks.

Fans of the Nasdaq-100 argue that while other indices like the S&P 500 reflect the businesses of the present, the tech-heavy index represents the companies of the future. For ETF investors, it can be a straightforward and cost-effective way to access global high-tech and emerging themes, including areas like artificial intelligence (AI). It excludes major technology firms listed on other exchanges, however, such as Salesforce, SAP and Oracle.

Using leverage for the ups and downs

If you’re an investor who wants to play the market’s ups and downs, BetaPro by Global X’s lineup of Nasdaq-100-focused leveraged and inverse-leveraged ETFs can be an effective way to potentially transform even low levels of volatility into more meaningful gains. Many already make use of the BetaPro Nasdaq-100® 2x Daily Bull ETF (QQU) and the BetaPro Nasdaq-100® -2x Daily Bear ETF (QQD) to express directional views. On June 17, the company expanded its lineup with newly launched 3x leveraged and inverse leveraged versions of these funds.

Both ETF variations track the index, but they seek to provide either up to 200% or 300% of the daily performance of the Nasdaq-100. Until now, Canadian investors seeking higher leveraged exposure to the index had to buy U.S.-listed funds or use margin accounts, which can increase costs and add additional complications. The BetaPro 3x Nasdaq-100 Daily Leveraged Bull Alternative ETF (TQQQ) and the BetaPro -3x Nasdaq-100 Daily Leveraged Bear Alternative ETF (SQQQ) trade on the Toronto Stock Exchange, in Canadian dollars and use foreign currency hedging, which offers domestic investors the opportunity to make daily bets with these powerful tools at among the lowest possible transaction costs and without the worry of currency fluctuations impacting the return profile.

Using 3x leveraged and inverse ETFs

With BetaPro’s new Nasdaq-100 ETFs, you can magnify the index’s daily performance while keeping your investments within Canadian-listed strategies. Say the Nasdaq gains 1% on a given day, which isn’t a rare occurrence given the index’s inherent volatility. TQQQ should gain 3%, resulting in a potentially meaningful daily profit even with a modest capital outlay. Of course, losses will also be amplified, but if you think the market will fall, you can trade SQQQ instead. While SQQQ would lose 3% in the 1% underlying index gain scenario, it would rise 3% on a day the Nasdaq-100 stumbled 1%.

It’s important to know that leveraged ETFs can suffer losses over multiple days of volatility without a clear market direction due to compounding and daily resetting of market exposure, making them unsuitable for long-term holdings. The table below demonstrates how a 3x leveraged fund would hypothetically perform over five days of mixed trading.

FOR ILLUSTRATIVE PURPOSES ONLY

As you can see, even if the index ends up at zero after five days, the Bull ETFs lose money. We used smaller fluctuations to represent normal trading activity, but those losses could be much larger if the market experiences more extreme swings. For this reason, BetaPro’s leveraged ETFs are designed for very short-term holding periods, such as one day.

Use cases for TQQQ and SQQQ:

- Strong conviction short-term trades: When the data suggests there is likely going to be a directional movement in the index over one or more days – for example, due to a U.S. Federal Reserve rate decision – traders can take greater advantage of the news and, hopefully, make more meaningful gains.

- Hedging: This kind of leverage allows you to hedge against unexpected outcomes within the rest of your portfolio for a relatively small investment.

- Volatility play: Since these ETFs are designed to magnify price movements, they can provide a way for traders to speculate on volatility itself.

The Nasdaq (and its corresponding ETFs) has long been a go-to index for investors who want to add a little more torque to their portfolios, but with new leveraged and inverse leveraged options, you can take even more advantage of the ups and downs.

Interested in other ways to trade the Nasdaq-100 using BetaPro ETFs?

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (“Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (“Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”). The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to or equal to either 200% or –200% of the performance of a specified underlying index, commodity futures index, or benchmark (the “Target”) for a single day. Each Inverse ETF seeks a return that is –100% of the performance of its Target. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF’s or Inverse ETF’s returns over periods other than one day will likely differ in amount and, particularly in the case of the Leveraged and Inverse Leveraged ETFs, possibly direction from the performance of their respective Target(s) for the same period. For certain Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF’s counterparties at that time. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

The BetaPro Products include the 3x and -3x ETFs and will use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These 3x and -3x ETFs are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their prospectus. Each 3x and -3x ETF seeks a return, before fees and expenses, that is equal to either 300% or –300% of the performance of a specified underlying index (the “Target”) for a single day. Due to the compounding of daily returns, a 3x and -3x ETF’s returns over periods other than one day will likely differ in amount and possibly direction from the performance of their respective Target(s) for the same period. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for sophisticated investors who have the capacity to absorb a loss of some or all of their investment. Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Nasdaq®, Nasdaq-100®, and Nasdaq-100 Index® are trademarks of The Nasdaq Stock Market, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Global X Investments Canada Inc. The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S).

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published July 11, 2025